Labor Market Analysis in the High-Tech Industry: Insights and Trends

- Maryna Khomich

- Feb 20, 2024

- 6 min read

The current state of the high-tech industry is attracting considerable attention, especially in light of the significant number of layoffs observed within high-tech companies over the past two years, a trend that persists into 2024. The prevailing economic and geopolitical climates further amplify this concern. Through an in-depth analysis of various Global market reports, I have derived key insights and perspectives that I aim to share in this article.

A primary point of debate centers around whether the high-tech market is experiencing growth or decline. This uncertainty is escalated by the ongoing layoffs and the noticeable increase in high-tech professionals seeking employment opportunities on platforms like LinkedIn, a trend previously uncommon in this sector. Many interpret these signs as indicative of a downturn in the field. The year 2023 was particularly challenging, and it is anticipated that this period of crisis will extend into the coming years. However, the situation is not entirely straightforward.

Assessing the State of the High-Tech Industry

To accurately evaluate the current state of the industry, it is essential to consider various factors. Primarily, the investment climate and the volume of investments made during a specific period serve as crucial indicators. Observing this aspect reveals that in 2023, technology startups witnessed a reduction in investment levels compared to the preceding years of 2021 and 2022, paralleled by a decrease in the number of companies launching Initial Public Offerings (IPOs).

However, a closer examination of regional trends shows a varied picture. In Europe, the post-pandemic decline in investment activities was not as severe as in the United States, even surpassing the 2020 figures.

A similar pattern is observed in Africa and Oceania.

This situation may initially suggest the onset of a crisis, but a deeper analysis suggests otherwise. The investment volumes by venture capital funds in 2021 and 2022 were exceptionally high, marking a significant leap from previous years. This trend is clearly illustrated in the accompanying chart. When considering investment activity over several years, it becomes evident that the 2023 figures align closely with those of 2019, the pre-pandemic era.

Challenges and Opportunities in Various Sectors

Moreover, many venture capital funds have adapted their investment strategies to align with emerging trends, also revisiting their preferred industries for investment. This strategic shift is indicative of the evolving landscape of venture capital investment.

In 2023, various sectors in the United States faced noteworthy challenges. An overview of these sectors includes:

Consumer-Focused Tech Companies: Market uncertainties, shifts in consumer behavior, and critical evaluation of company valuations created a challenging environment. This led to increased investor caution in funding startups within this segment.

Cryptocurrency and Blockchain: The sector contended with regulatory ambiguities, security vulnerabilities, and environmental concerns related to mining. Despite its potential, the industry endured skepticism and fluctuated considerably.

Healthcare and Biotech: These fields continued to draw investment but confronted hurdles such as prolonged drug development timelines, unpredictable clinical trial results, and stringent regulatory processes. The pandemic accentuated both the necessity for innovation and the associated risks.

Renewable Energy: Supply chain disruptions, geopolitical conflicts, and policy shifts posed significant challenges, even as the sector remained a focal point for sustainability efforts.

Retail and E-Commerce: Rapid evolution in the retail sector saw traditional businesses adapting to e-commerce and direct-to-consumer models. However, they faced stiff competition, supply chain issues, and evolving consumer preferences.

Automotive and Electric Vehicles: The shift towards electric vehicles was impeded by battery shortages, infrastructure deficiencies, and changes in regulatory landscapes, affecting both established and emerging players.

In contrast (according to https://www.gartner.com/en/articles/gartner-top-10-strategic-technology-trends-for-2024), sectors currently in high demand include:

AI Trust, Risk, and Security Management (AI TRiSM): As AI evolves, balancing innovation with the protection of sensitive data becomes crucial, spurring investment in trustworthy AI technologies.

Continuous Threat Exposure Management (CTEM): The growing complexity of cyber threats necessitates continuous risk monitoring and proactive management, enhancing overall security strategies.

Sustainable Technology: With sustainability as a priority, investments are channeling into technologies that reduce environmental impact and promote circular economy principles.

Platform Engineering: The focus is on developing scalable, adaptable, and efficient technology platforms tailored to specific industry needs and fostering innovation.

AI-Augmented Development: AI's role in software development is expanding, automating tasks, improving code quality, and boosting developer productivity.

Industry Cloud Platforms: Customized cloud solutions tailored for specific industries are gaining traction, offering specialized features, compliance, and scalability.

Intelligent Applications: Applications enhanced with AI and machine learning are becoming more widespread, automating processes, personalizing experiences, and increasing efficiency.

Democratized Generative AI: Generative AI, capable of creating new content, is becoming more accessible. By 2026, it is anticipated to significantly transform design and development efforts in web and mobile applications.

Analyzing Layoffs and Regional Trends

Another critical aspect to assess for understanding the industry's developmental trajectory is the extent of downsizing within the sector. Data from layoffs.fyi indicates that the trend of layoffs, which commenced in 2022, escalated to its zenith in 2023 and persists into 2024, exhibits varying characteristics and scales across different regions.

Focusing on regional impacts, it is evident that America experienced the highest number of layoffs. In contrast, Europe was comparatively less affected, accounting for only about 10% of the global layoffs. The provided chart offers a detailed visualization of this trend within the European context according to https://stateofeuropeantech.com/talent#C3-0-layoffs.

This analysis reveals several key insights. Firstly, European legislation offers more robust employee protections, making the rapid and extensive layoffs observed in America less feasible in Europe. Secondly, many European companies adopt a diversified workforce strategy, integrating contractors and outsourcers from various firms. This approach led companies to primarily reduce their reliance on external contractors and outsourcers while retaining their core internal staff during times of downsizing.

Furthermore, the nature of the layoffs in 2023 and 2024 differs significantly from those in 2022. The recent layoffs are not primarily driven by economic factors, as openly acknowledged by the companies conducting them. This shift in the underlying reasons for workforce reductions is a crucial aspect of the current industry landscape.

Companies are indicating that while they are financially stable, they are choosing to optimize their operations. This trend is particularly noticeable among large corporations that are publicly traded and have undergone layoffs. They observe that the market often responds positively to such actions, with an increase in the company's stock value.

This observation has led to the wider adoption of this strategy, as it appears beneficial for business without significantly tarnishing the employer's reputation. This is especially true given the prevalence of such practices across various companies. Smaller companies, on the other hand, may resort to layoffs for more pressing economic reasons. In the post-pandemic landscape, changes in consumer behavior and service usage have impacted cash flows, necessitating some companies to "cut the fat" and optimize their structures, though this is not universally the case.

Additionally, it's seen that some smaller companies mimic the actions of larger ones. Instances occur where upper management questions middle management about the absence of similar downsizing measures in their own operations, under the premise of optimizing the workforce in line with larger corporations.

Therefore, it becomes clear that not all layoffs are directly tied to the actual economic and financial health of the company.

Salary Market Trends

Another vital aspect to consider is the state of the salary market in the high-tech industry. There has been speculation about a concerted effort by large companies, particularly those in the group formerly known as FAANG (now MAANG), to influence the salary market by initiating layoffs. The intention behind this supposed strategy was to temper the rapid growth of salaries. While distinguishing fact from fiction in this theory is challenging, the salary trends present an interesting narrative.

Despite the wave of layoffs, salary levels did not witness a significant decline. According to data from the Levels FYI website, 2023 saw only a marginal decrease in the salaries of product designers and software engineers compared to 2022.

In contrast, salaries for other high-tech roles either remained stable or experienced an increase. This indicates a dichotomy in the industry: while some companies are downsizing, others continue to recruit, keeping the job market active and viable for job seekers. The situation with salaries remains intriguing, showing resilience against an economic crisis.

In Europe, the high-tech industry's salary trends in 2023 were particularly positive, not showing a decrease from 2022 but rather a continued upward trajectory. For instance:

Belgium witnessed the highest projected increase in salaries at 10.5%, driven by automatic wage indexation linked to inflation.

In the United Kingdom, salaries were expected to rise by 5.1%.

Germany anticipated a 4.6% increase in high-tech industry salaries.

Spain was projected to see a 3.6% growth in compensation.

These statistics indicate that the high-tech sector in Europe maintained its resilience and competitiveness in terms of salary levels throughout 2023.

AI’s Impact on the Labor Market

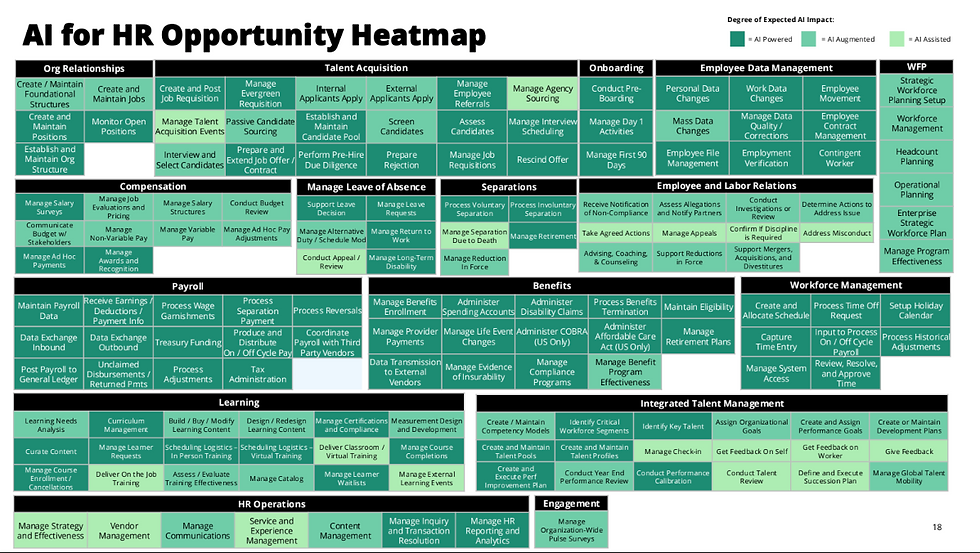

Another perspective frequently cited in discussions about layoffs in high-tech companies and the perceived crisis in the industry is the advancement of Artificial Intelligence (AI), particularly generative AI. The advent of technologies such as ChatGPT, Gemini, Bing, and others has led many companies to integrate AI into their business processes for optimization and efficiency enhancement. This approach has proven effective.

A significant number of startups and emerging companies are grounding their business models on the application of AI. As a result, part of the recent layoffs in the labor market can be attributed to companies' increasing reliance on AI for operational efficiency, leading them to phase out less efficient units.

For job seekers, this trend underscores the importance of re-evaluating and updating their skill sets. The current market demands not just the ability to retain a job and increase income, but also the need for competencies that are relevant and adaptable to the evolving business landscape. We will delve deeper into this topic in our forthcoming materials.

Materials that were used in the preparation of this article:

https://www.cbinsights.com/research/report/venture-trends-2023/

https://www.gartner.com/en/articles/gartner-top-10-strategic-technology-trends-for-2024

https://www.startus-insights.com/innovators-guide/most-funded-technologies/

https://www.mckinsey.com/capabilities/mckinsey-digital/our-insights/the-top-trends-in-tech#/

https://www2.deloitte.com/us/en/insights/focus/tech-trends/2023.html#explore-whats-next

https://www.nytimes.com/2024/01/30/business/dealbook/tech-layoffs.html

https://www.dqindia.com/news/cisco-layoffs-why-are-it-companies-reducing-workforce-3844675

https://news.stanford.edu/2022/12/05/explains-recent-tech-layoffs-worried/

Comments